A new study shows how little tax the super-rich pay

Wealth inequality may be worse than previously thought

OF LIFE’s two certainties, death cannot be dodged even by the well-to-do. Taxes are another matter. Quantifying quite how much they manage to keep from the taxman, however, has always been tricky. One common approach governments take is to conduct randomised audits of tax returns. This methodology can give regulators a rough sense of overall tax revenues lost. But it is far from ideal. For instance, studies based on randomised tax audits are usually both too small and too crude to reflect accurately the financial shenanigans of the most egregious tax-dodgers: the super-rich.

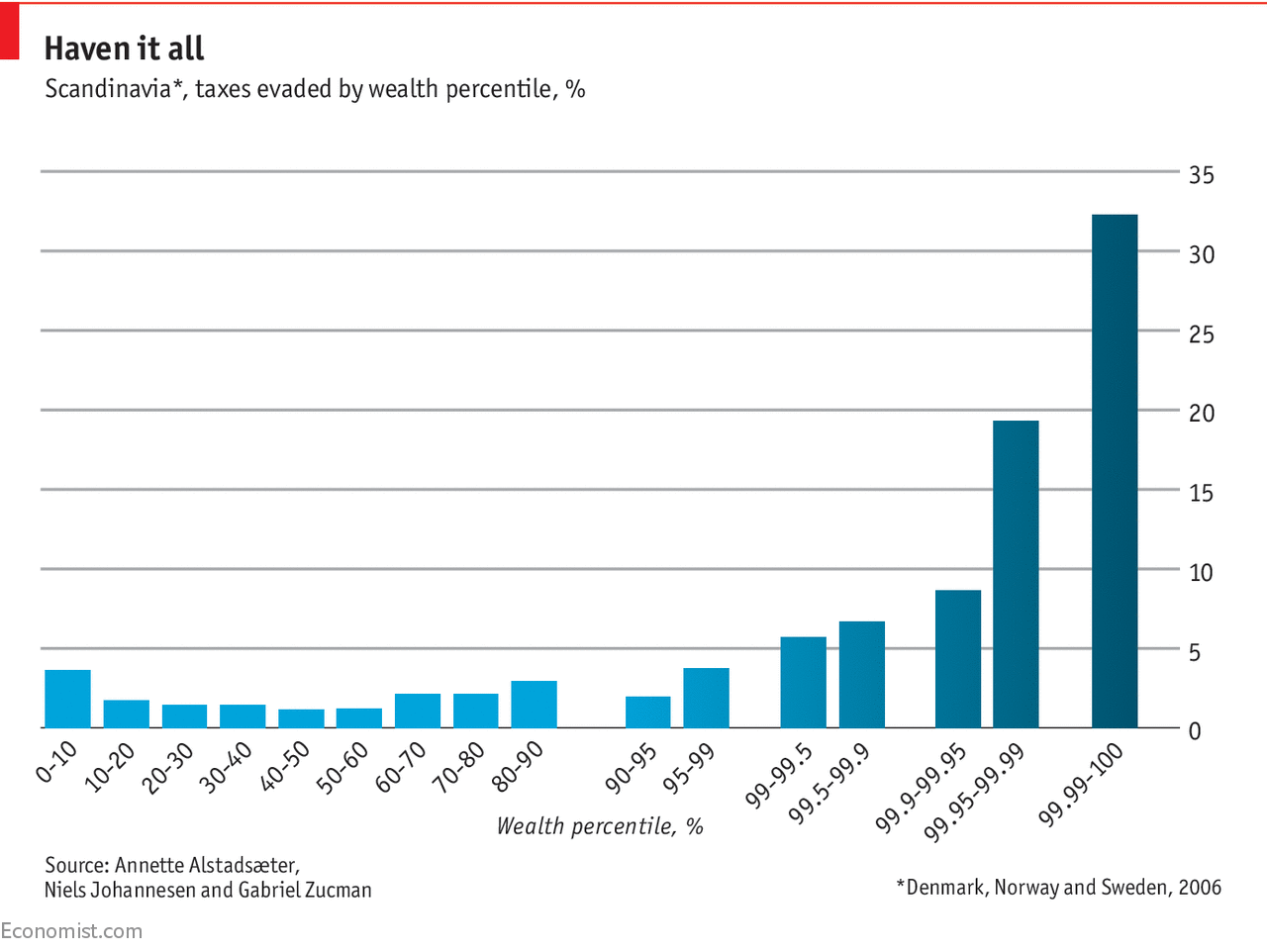

A new study by Annette Alstadsæter, Niels Johannesen and Gabriel Zucman, three economists, tackles this problem by investigating two recent financial-data hoards: the “Swiss leaks”, a record of bank accounts held at HSBC in Switzerland; and the “Panama papers”, files that document the use of offshore accounts and shell companies by clients of Mossack Fonseca, a law firm in Panama. By matching the leaked information with wealth data from Denmark, Norway and Sweden, the authors are able to construct the most detailed estimate to date of the extent of tax evasion.

Their research leads to two conclusions. First, tax evasion is extremely concentrated. The average Scandinavian household paid around 3% too little in taxes in 2006; the richest 1% of households, with net assets of at least $2m, underpaid by around 10%. The truly rich, though, behave truly differently. The top 0.01% of households, with net assets of over $40m, short-changed the taxman by a whopping 30%.

Second, the numbers imply that previous estimates of wealth inequality, often based on tax data, have understated the problem. And the Scandinavian statistics may provide a conservative estimate of worldwide tax-dodging: only around 2% of Scandinavian household wealth is held in offshore accounts, compared with the global average of 4%.

Globalisation has disproportionately benefited the rich in part by rewarding capital more handsomely than labour. But globalisation has also made it easier for the well-heeled to hide their wealth. In that sense, maybe the data should cause even more surprise: despite the best efforts of a lucrative global tax-evasion industry, Scandinavia’s ultra-rich are paying 70% of their taxes.

This article appeared in the Finance and economics section of the print edition under the headline "Gimme shelter"

A new study by Annette Alstadsæter, Niels Johannesen and Gabriel Zucman, three economists, tackles this problem by investigating two recent financial-data hoards: the “Swiss leaks”, a record of bank accounts held at HSBC in Switzerland; and the “Panama papers”, files that document the use of offshore accounts and shell companies by clients of Mossack Fonseca, a law firm in Panama. By matching the leaked information with wealth data from Denmark, Norway and Sweden, the authors are able to construct the most detailed estimate to date of the extent of tax evasion.

Latest updates

Second, the numbers imply that previous estimates of wealth inequality, often based on tax data, have understated the problem. And the Scandinavian statistics may provide a conservative estimate of worldwide tax-dodging: only around 2% of Scandinavian household wealth is held in offshore accounts, compared with the global average of 4%.

Globalisation has disproportionately benefited the rich in part by rewarding capital more handsomely than labour. But globalisation has also made it easier for the well-heeled to hide their wealth. In that sense, maybe the data should cause even more surprise: despite the best efforts of a lucrative global tax-evasion industry, Scandinavia’s ultra-rich are paying 70% of their taxes.

This article appeared in the Finance and economics section of the print edition under the headline "Gimme shelter"

No comments:

Post a Comment